Program Director

Raj Chetty is the William A. Ackman Professor of Economics at Harvard University, where he also directs Opportunity Insights, a research organization that studies economic mobility. His research focuses on the measurement and explanation of mobility across income and social strata, with particular attention to the role of government policies. He has been an NBER affiliate since 2003.

Featured Program Content

For more than 75 years, the federal government has been the largest funder of scientific research at US colleges and universities. Federal science...

In 2013, the Portuguese government offered foreign retirees relocating to Portugal a 10-year tax exemption on their foreign-source pension income,...

Wage insurance (WI) aims to mitigate the negative impacts of job loss and to encourage reentry into the labor market by providing partial income...

Loding Complete

Explore Program Content

April 16-17, 2026 - Conference

February 26-27, 2026 - Conference

November 21, 2025 - Conference

October 24, 2025 - Conference

October 24, 2025 - Conference

October 23-24, 2025 - Conference

September 18, 2025 - ConferenceProgram

September 11-12, 2025 - ConferenceProgram

Book - Conference Volume

Book - Conference Volume

Policy Responses to Tax Competition provides an in-depth exploration of how jurisdictions design taxes on mobile economic factors. Tax competition between jurisdictions that seek to attract businesses and residents presents both opportunities and challenges. It can foster government efficiency and...

July 22-23, 2025 - ConferenceProgram

Author(s) - Patrick K. Krause, Elizabeth Rhodes, Sarah Miller, Alexander W. Bartik, David E. Broockman ⓡ Eva Vivalt

This paper examines the impact of a large, randomized cash transfer on parental behaviors, investment in children, children's social, behavioral, and educational outcomes, and pregnancy and childbearing. We find that parents who were randomly selected to receive a $1,000 per month unconditional cash...

While many socialist countries suffered from harsh economic crises, studying their impacts on economic and political attitudes is challenging because of the scarcity of reliable data in nondemocratic contexts. We study a democratic socialist setting where we have ample information on such attitudes:...

We study the role of job transitions and firm pay policies in the Black-White earnings gap in the US. We use administrative data for the universe of employer-employee matches from 2005-2019 to analyze worker mobility in a general but tractable framework, which allows for firm effects that depend on...

The attendance rate at religious services is an important variable for the sociology and economics of religion, but long-term and global data are scarce. Retrospective questions from the International Social Survey Program (ISSP) allow the construction of rates of religious-service attendance back...

Author(s) - Trevor J. Bakker, Stefanie DeLuca, Eric A. English, James S. Fogel, Nathaniel Hendren & Daniel Herbst

We construct new population-level linked administrative data to study households access to credit in the United States. By age 25, Black adults, those who grew up in low-income families, and those raised in the Southeast or Appalachia already have significantly lower credit scores than other groups,...

This paper evaluates Laffer curves produced by reforms to nonlinear income taxes, focusing on individual taxpayers. A reform puts a taxpayer on the wrong side of the Laffer curve if it increases their tax burden while reducing tax payments. There always exist potential reforms with this property...

In recent years, policy makers have adopted many measures to incentivize the establishment of employer-sponsored retirement plans (ESRPs). One such measure implemented in the early 2000s and made more generous in recent years allows smaller firms that establish an ESRP to claim a tax credit to...

Author(s) - Michael C. Best, Luigi Caloi, François Gerard, Evan Plous Kresch, Joana Naritomi & Laura Zoratto

Governments frequently use proxies for deservingnesstagsto implement progressive tax and transfer policies. These proxies are often imperfect, leading to misclassification and inequities among equally deserving individuals. This paper studies the efficiency effects of such misclassification in the...

July 17-18, 2025 - ConferenceProgram

In contracting out, monitoring is an important policy tool to extract information on firm quality and incentivize quality provision. This paper examines a central quality inspection of nursing homes, a sector with significant welfare implications but widespread public concerns about its quality of...

Author(s) - Gary Charness, Ramon Cobo-Reyes, Nicola Lacetera, Juan A. Lacomba, Francisco Lagos, Mario Macis, Juliette Milgram-Baleix & María José Ruiz-Martos

We conducted a large-scale field experiment in Granada, Spain, to assess the motivating effect on blood donation of matching each attempt to donate with a charitable contribution pledge for children in developing countries. The intervention involved 344 blood drives and 21,888 participants. Compared...

This introductory chapter outlines key criteria for evaluating experimental measures, and connects these criteria to the selection of experimental parameters across various contexts. We aim for this chapter to serve as a framework for assessing the different measures, elicitations, and designs...

We analyze the effect of California's $20 fast food minimum wage, which was enacted in September 2023 and went into effect in April 2024, on employment in the fast food sector. In unadjusted data from the Quarterly Census of Employment and Wages, we find that employment in California's fast food...

Author(s) - Benjamin Schoefer

This paper explores a repositioning of Europes labor market institutions as potential drivers of the transatlantic gap in macroeconomic performance. Institutional diagnoses were prominent in times of high European unemployment in the 1980-90s. But interest waned as joblessness felleven though the...

The Earned Income Tax Credit is unique among social programs in that benefits are not paid out evenly across the calendar year but are received in a lump-sum cash payment. We exploit this feature of the EITC to investigate how receiving this influx of cash affects food expenditure patterns of...

Most U.S. states have workforce development programs that offer firms grants to train their own workers. We create unique data linkages between participating firms, employment, and vacancies to explore the determinants and consequences of such programs. Training grants are more prevalent in markets...

We study racial inequality in 21st century France. Using parents nationality at birth, we overcome the lack of ethno-racial statistics stemming from the countrys color-blind approach. We document substantial earnings penalties for racial minorities along the income distribution. Penalties are larger...

This paper revisits the relationship between federal debt and interest rates, which is a key input for assessments of fiscal sustainability. Estimating this relationship is challenging due to confounding effects from business cycle dynamics and changes in monetary policy. A common approach is to...

This study investigates the effectiveness of donation matching gift schemes using lotteries for increasing charitable giving relative to deterministic matches of equivalent or higher expected value and a no-match control. We recruit 1,402 online participants and randomly assign them to one of seven...

Author(s) - Ran Abramitzky, Leah Platt Boustan, Harriet M. Brookes Gray, Katherine Eriksson, Santiago Pérez, Hannah M. Postel, Myera Rashid & Noah Simon

We introduce a new rule-based linking method for historical Census records. We augment earlier algorithms based on name, age and place of birth (Abramitzky, Boustan, Eriksson, 2012, or basic ABE), with five matching characteristics middle initial, county of residence, and spouse and parents names....

The paper has been temporarily withdrawn at the request of the authors. Please check back later....

The development of English-language skills, a near necessity in todays global economy, is heavily influenced by historical national decisions about whether to subtitle or dub TV content. While prior studies of language acquisition have focused on schools, we show the overwhelming influence of out-of...

Theoretical rationales for employer-provided pensions often focus on their ability to increase employee effort and selectively retain quality workers. We test these hypotheses using rich administrative data on public school teachers around the pension-eligibility threshold. When teachers cross the...

This paper analyzes the importance of doctor discretion in medical evaluations. Leveraging comprehensive administrative data and random assignment of doctors to evaluations in workers compensation insurance, we identify the scope for doctor discretion in medical evaluations of injured workers and...

This study analyzes, for the first time, the effect of increases in the minimum wage on the labor market outcomes of working age adults with cognitive disabilities, a vulnerable and low-skilled sector of the actual and potential labor pool. Using data from the American Community Survey (2008-2023),...

In the United States, unemployment insurance (UI) is funded through employer-side payroll taxes that are experience-rated based on previous UI claims. States differ significantly with respect to the financing of their programs, and a majority of state programs do not currently meet minimum UI trust...

This paper examines how central banks can strategically integrate artificial intelligence (AI) to enhance their operations. Using a dual-framework approach, we demonstrate how AI can transform both strategic decision-making and daily operations within central banks, taking the Federal Reserve System...

July 3, 2025 - Article

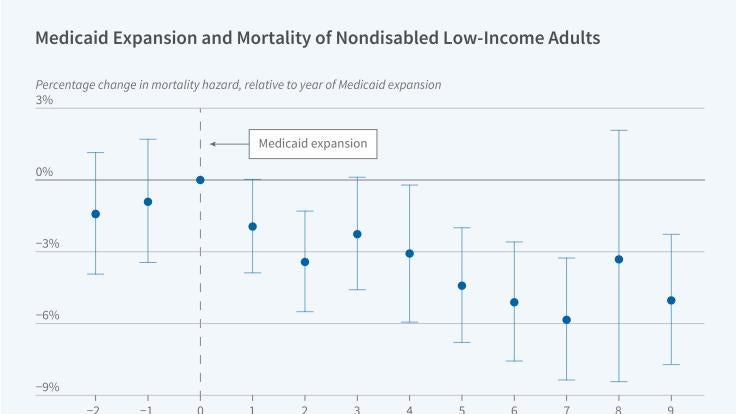

Lower-income adults in the US are more likely to lack health insurance and to suffer worse health, a correlation that raises the long-standing question of whether health insurance affects health. In Saved by Medicaid: New Evidence on Health Insurance and Mortality from the Universe of Low-Income...

July 1, 2025 - Article

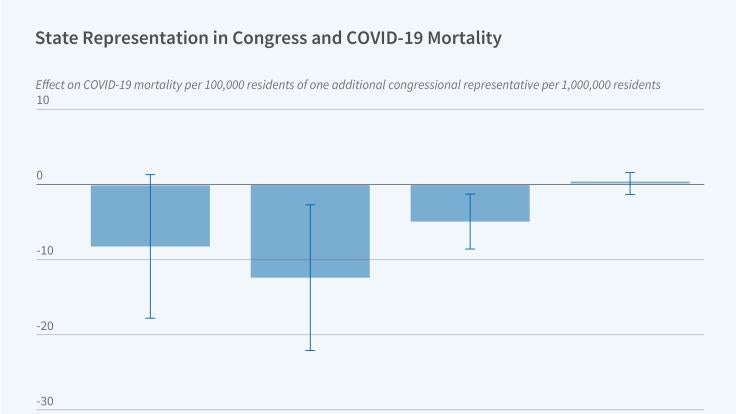

During the COVID-19 pandemic, the US federal government provided nearly $1 trillion in fiscal assistance to state and local governments with the goal of supporting public health, public schools, and local economic recovery. In Health Impacts of Federal Pandemic Aid to State and Local Governments ...

July 1, 2025 - Article

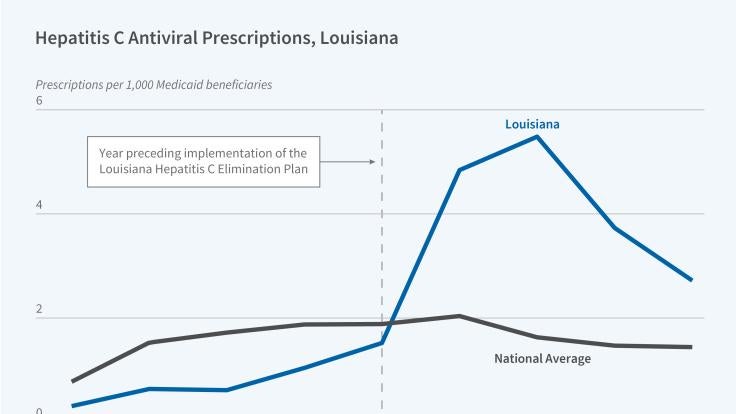

The hepatitis C virus (HCV) is a major public health concern due to its high infection and mortality rates. Recent pharmaceutical innovations known as direct-acting antivirals (DAAs) have the potential to cure HCV and can also generate positive health externalities through reduced transmission....

July 1, 2025 - Article

For more than 75 years, the federal government has been the largest funder of scientific research at US colleges and universities. Federal science funding includes both direct costs for specific research activities and indirect costs that support the facilities, equipment, and administrative...

July 1, 2025 - Article

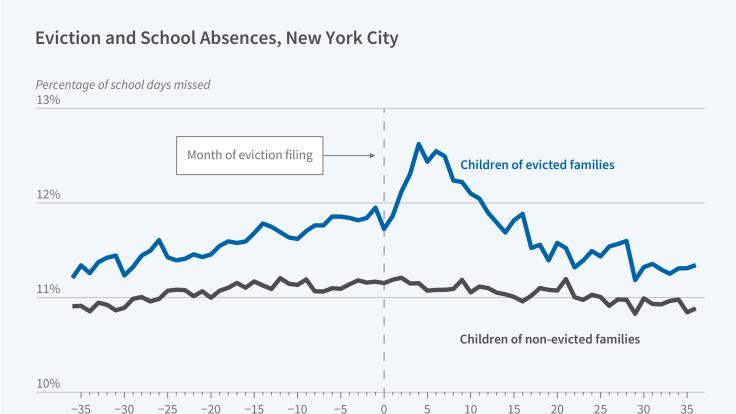

Author(s) - Robert Collinson, Deniz Dutz, John E. Humphries, Nicholas S. Mader, Daniel Tannenbaum & Winnie van Dijk

Concern about childrens welfare is often cited as a reason for strong tenant protection laws. In The Effects of Eviction on Children (NBER Working Paper 33659), Robert Collinson, Deniz Dutz, John Eric Humphries, Nicholas S. Mader, Daniel Tannenbaum, and Winnie van Dijk provide new evidence on the...

Using newly-collected data on the near-population of U.S. STEM PhD graduates since 1950, we examine who funds PhD training, how many graduates are trained in areas of strategic national importance, and the effects of public investment in PhD training on the scientific workforce. The U.S. federal...

Author(s) - Silvia Vannutelli

Stimulus transfers are widely used during economic downturns, yet they are often poorly targeted from an economic perspective. I show that political incentives might help explain this discrepancy. I study one of the largest stimulus tax credits in Italy which excluded the poorest individuals and...

Author(s) - Judith Scott-Clayton, Irwin Garfinkel, Elizabeth Ananat, Sophie M. Collyer, Robert Paul Hartley, Anastasia Koutavas, Buyi Wang & Christopher Wimer

In 2015, the City University of New York (CUNY) launched a new program Accelerate, Complete, and Engage (ACE)aimed at improving college graduation rates. A prior randomized-control evaluation of the program found a nearly 12 percentage point increase in graduation five years after college entry....

With the goal of lowering incentives for alcohol and substance abuse, U.S. states have historically permitted private health insurers to deny reimbursement of medical claims stemming from alcohol or opioid impairment. However, a potential unintended consequence of such exclusion provisions is that...

A smaller human population would emit less carbon, other things equal, but how large is the effect? Here we test the widely-shared view that an important benefit of the ongoing, global decline in fertility will be reductions in long-run temperatures. We contrast a baseline of global depopulation...

In overturning Roe v. Wade and triggering laws in many states that ban or severely restrict abortions, the Supreme Courts landmark 2022 Dobbs decision dramatically altered the landscape for reproductive health in the U.S. Prior research has highlighted the far-reaching impact of abortion...

Author(s) - Sara Ayllón, Lars J. Lefgren, Richard W. Patterson, Olga B. Stoddard & Nicolás Urdaneta Andrade

How should gender discrimination and systemic disadvantage be addressed when more discriminatory and less generous students systematically sort into certain fields, courses, and instructors sections? In this paper, we estimate measures of gender bias and evaluation generosity at the student level by...

- ...

Show: results