Winning the H-1B Visa Lottery Boosts the Fortunes of Startups

Young firms that employ high-skilled foreign workers are more likely to attract high-reputation venture capital and win more patents and citations.

The opportunity to hire specialized foreign workers gives startups a leg up over their competitors who do not obtain visas for desired employees. High-skilled foreign labor boosts a firm’s chance of obtaining venture capital funding, of successfully going public or being acquired, and of making innovative breakthroughs.

Those are among the findings of Give Me Your Tired, Your Poor, Your High-Skilled Labor: H-1B Lottery Outcomes and Entrepreneurial Success (NBER Working Paper 26392) by Stephen G. Dimmock, Jiekun Huang, and Scott J. Weisbenner

US firms access the pool of high-skill foreign workers through the H-1B visa system. Each fiscal year, the federal government issues a fixed number of these visas to for-profit firms. An H-1B visa is valid for three years, and is renewable once for another three years. Opponents of this program argue that foreign workers displace American workers; proponents counter that the US has a shortage of high-skilled labor and that foreign workers fill the gap, spurring investment and innovation by domestic firms.

The researchers surveyed nearly 1,900 startups, most of which were in high technology fields and therefore highly dependent on human capital. The study looked at fiscal years 2008, 2009, 2014, and 2015, when H-1B visas were allocated to employers by lottery because demand exceeded the federal cap. Nearly half of the companies in the sample were in California, 10 percent were in Massachusetts, and 9 percent were in New York. Before participating in the lottery, all the firms had completed at least one round of external financing and none had gone public.

Nearly 60 percent of the firms sampled sought just one visa; only 7 percent applied for five or more. A firm's success in obtaining visas was measured by its "win rate," measured as the number of approved visas as a percentage of the number of applications. The average win rate in the sample was 55 percent. For the large number of firms that applied for just one visa, the win rate by construction was either 100 or zero percent.

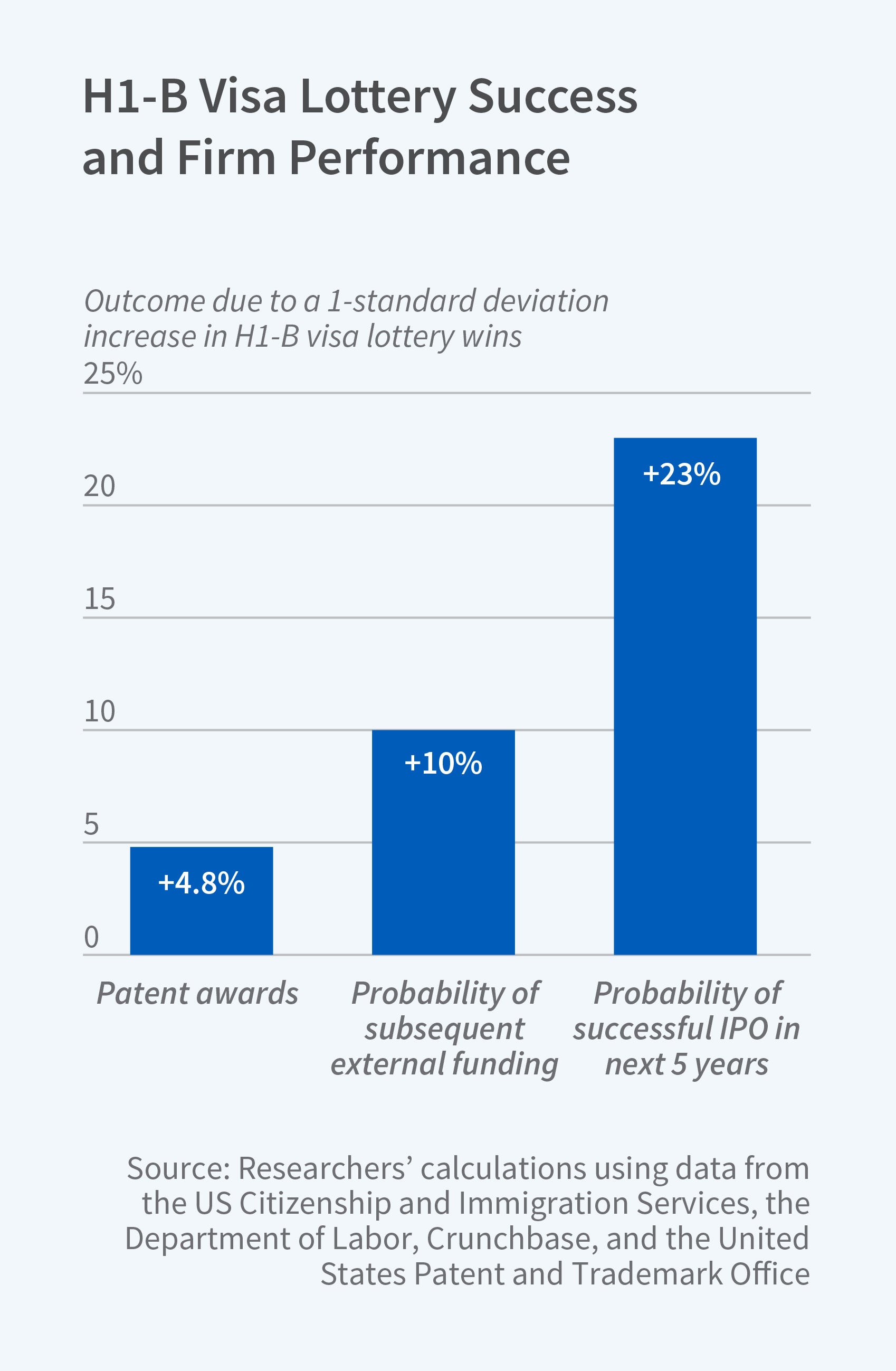

The study found that a higher win rate in the H-1B visa lottery was associated with an increase in the likelihood of obtaining external funding. For example, firms with a win rate of 100 percent subsequently received funding in the next three years 49 percent of the time, compared with 41 percent for those with a win rate of zero.

Lottery winners were also more likely to receive funding from high-reputation venture capitalists. Association with an elite VC often comes with greater access to expertise, resources, and business networks. Winners also received a higher number of patents and patent citations.

The study also considered whether firms later conducted an initial public offering or were acquired for at least $25 million (in inflation-adjusted 2008 dollars) — both indicators of a "successful exit" during the post-lottery period. Over a five-year period, a one standard deviation increase in the win rate was associated with a 20 percent increase in the probability of a successful exit, relative to the baseline exit rate.

While the researchers focused on startups, they point out that their findings could have economy-wide implications since some of today's successful startups are tomorrow's large employers.

— Steve Maas